All Categories

Featured

Table of Contents

For instance, if the home owner pays the passion and charges early, this will certainly reduce your return on the investment. And if the home owner declares insolvency, the tax lien certificate will be subordinate to the mortgage and federal back taxes that schedule, if any type of. Another threat is that the value of the home could be much less than the quantity of back taxes owed, in which instance the homeowner will certainly have little motivation to pay them.

Tax obligation lien certifications are usually marketed using public auctions (either online or in person) conducted annually by region or municipal straining authorities. Readily available tax liens are normally released several weeks before the auction, along with minimum bid quantities. Inspect the web sites of areas where you have an interest in acquiring tax obligation liens or call the region recorder's workplace for a checklist of tax lien certifications to be auctioned.

Tax Lien Investing In Texas

Most tax obligation liens have an expiration day after which time your lienholder civil liberties run out, so you'll need to relocate swiftly to enhance your chances of maximizing your financial investment return. Tax obligation lien investing can be a rewarding method to spend in property, however success calls for thorough study and due diligence

Firstrust has more than a decade of experience in offering financing for tax obligation lien investing, in addition to a dedicated group of qualified tax lien professionals that can help you utilize prospective tax lien spending chances. Please call us to read more about tax obligation lien investing. FT - 643 - 20230118.

The tax obligation lien sale is the final action in the treasurer's efforts to gather taxes on real estate. A tax lien is put on every area building owing taxes on January 1 every year and stays up until the real estate tax are paid. If the homeowner does not pay the real estate tax by late October, the region sells the tax lien at the annual tax lien sale.

The capitalist that holds the lien will certainly be alerted every August of any kind of unsettled taxes and can endorse those taxes to their existing lien. The tax obligation lien sale allows tiring authorities to obtain their allocated revenue without needing to wait on overdue taxes to be collected. It also provides an investment chance for the public, members of which can buy tax obligation lien certifications that can possibly gain an eye-catching rates of interest.

When redeeming a tax obligation lien, the homeowner pays the the delinquent tax obligations along with the delinquent interest that has actually accumulated versus the lien given that it was cost tax obligation sale, this is attributed to the tax lien holder. Please get in touch with the Jefferson County Treasurer 303-271-8330 to get payoff information.

Tax Lien Invest

Residential property becomes tax-defaulted land if the residential or commercial property tax obligations remain unsettled at 12:01 a.m. on July 1st. Residential property that has actually come to be tax-defaulted after 5 years (or 3 years when it comes to residential property that is also subject to an annoyance reduction lien) ends up being based on the county tax obligation collection agency's power to sell in order to satisfy the defaulted residential or commercial property taxes.

The region tax obligation collector may offer the building available for sale at public auction, a sealed proposal sale, or a worked out sale to a public agency or certified not-for-profit company. Public public auctions are one of the most typical way of selling tax-defaulted home. The auction is conducted by the county tax enthusiast, and the residential or commercial property is offered to the highest possible prospective buyer.

Secret Takeaways Browsing the world of property financial investment can be complicated, but comprehending different investment possibilities, like, is well worth the work. If you're aiming to diversify your profile, purchasing tax obligation liens may be an option worth checking out. This guide is created to assist you recognize the fundamentals of the tax lien investment strategy, guiding you via its procedure and assisting you make informed decisions.

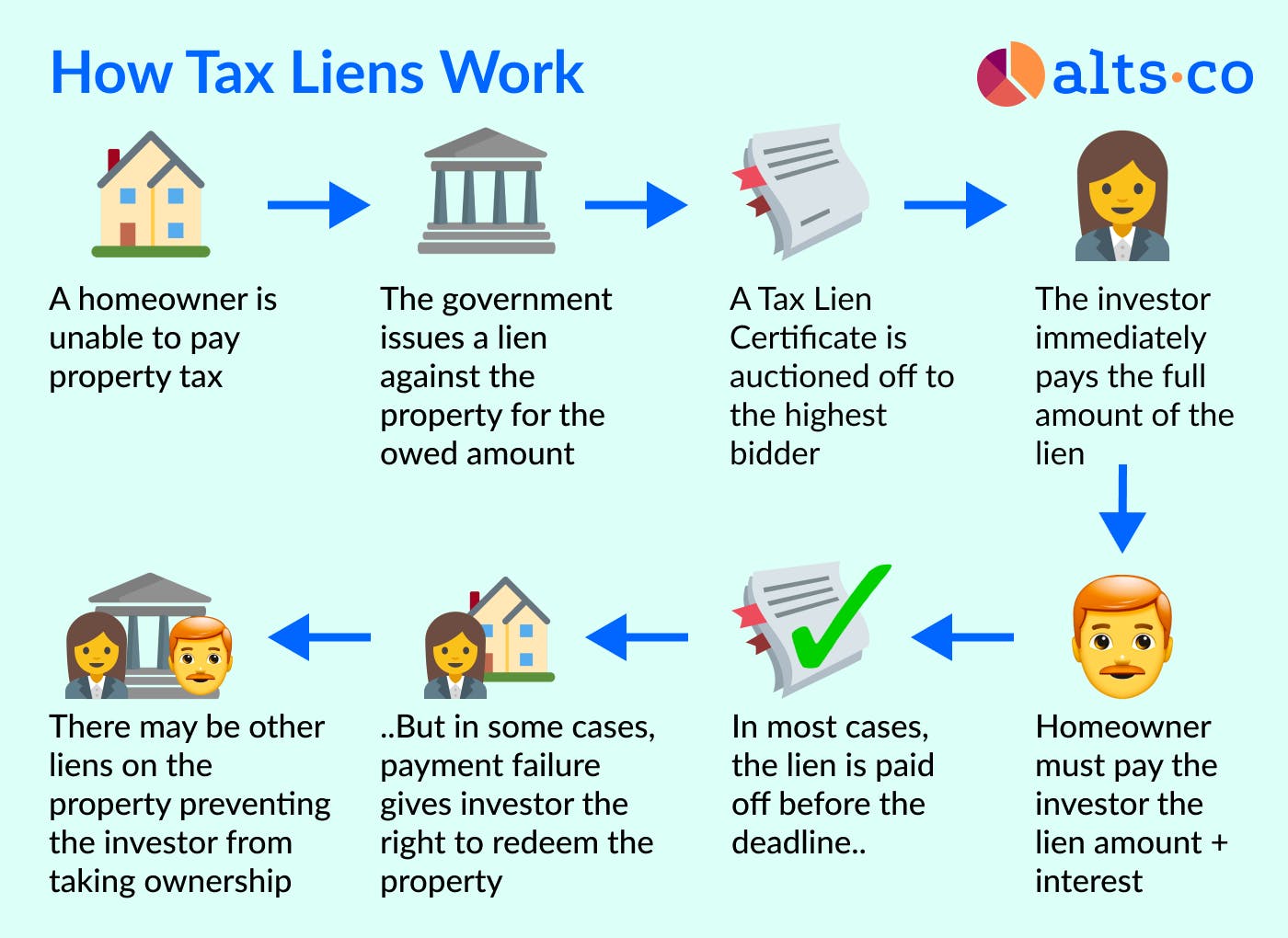

A tax lien is a lawful claim imposed by a government entity on a residential or commercial property when the proprietor fails to pay building tax obligations. It's a method for the federal government to make certain that it accumulates the necessary tax income. Tax liens are affixed to the home, not the person, suggesting the lien sticks with the property regardless of ownership adjustments until the financial debt is cleared.

Tax Lien Tax Deed Investing

Tax lien investing is a type of genuine estate investment that entails purchasing these liens from the federal government. When you spend in a tax lien, you're basically paying someone else's tax obligation financial obligation.

The regional government then positions a lien on the home and might at some point auction off these liens to capitalists. As an investor, you can purchase these liens, paying the owed taxes. In return, you get the right to collect the tax obligation debt plus rate of interest from the residential property owner. This rate of interest price can differ, yet it is usually higher than standard financial savings accounts or bonds, making tax lien investing possibly financially rewarding.

It's necessary to meticulously consider these prior to diving in. Tax obligation lien certification investing deals a much lower funding demand when compared to various other kinds of investingit's possible to delve into this property class for as little as a couple hundred dollars. One of one of the most significant attracts of tax lien investing is the potential for high returns.

In some instances, if the residential or commercial property proprietor falls short to pay the tax obligation financial debt, the capitalist may have the opportunity to foreclose on the property. This can possibly result in acquiring a home at a portion of its market price. A tax obligation lien often takes priority over other liens or mortgages.

Tax obligation lien investing entails navigating lawful treatments, specifically if repossession comes to be required. Redemption Periods: Building proprietors commonly have a redemption period during which they can pay off the tax obligation financial debt and interest.

Competitive Auctions: Tax obligation lien auctions can be extremely affordable, specifically for properties in desirable locations. This competitors can drive up prices and possibly minimize general returns. [Knowing just how to buy property doesn't have to be tough! Our online realty investing course has every little thing you need to reduce the discovering contour and start buying property in your area.

Tax Lien Investing Strategies

While these procedures are not complicated, they can be surprising to brand-new investors. If you have an interest in obtaining started, assess the following steps to getting tax liens: Start by educating on your own about tax obligation liens and just how genuine estate public auctions work. Understanding the lawful and economic complexities of tax lien investing is vital for success.

Latest Posts

Houses For Sale For Taxes Owed

Tax Foreclosed Properties For Sale

Tax Property Sale List